Economia Nova

Macroeconomia e mais. Recursos para as aulas do Professor Dr. Antony P. Mueller

sábado, 4 de março de 2023

segunda-feira, 30 de janeiro de 2023

segunda-feira, 23 de janeiro de 2023

sábado, 14 de janeiro de 2023

segunda-feira, 2 de janeiro de 2023

quarta-feira, 28 de dezembro de 2022

domingo, 25 de dezembro de 2022

domingo, 27 de novembro de 2022

sábado, 26 de novembro de 2022

Capital e o ciclo de negócios Parte IV

Capital e o ciclo de negócios PARTE IV

https://www.youtube.com/watch?v=AiHbizUwkzo&t=884s

segunda-feira, 21 de novembro de 2022

sexta-feira, 18 de novembro de 2022

Capital e o ciclo de negócios Parte II

Capital e o ciclo de negócios PARTE II

https://www.youtube.com/watch?v=57I8nTJEkUI&t=4s

https://www.youtube.com/watch?v=57I8nTJEkUI&t=4s

Capital e o ciclo de negócios PARTE I

Parte I da apresentação do meu modelo macroeconômico baseado no capital na Semana Acadêmica (SEMAC) da Universidade Federal de Sergipe (UFS) no 02 de novembro de 2022

sexta-feira, 28 de outubro de 2022

Investimentos diretos estrangeiros

O saldo entre ingressos e saídas do chamado Investimento Direto no País (IDP) foi de US$ 9,2 bilhões em setembro, o maior desde abril (US$ 11,1 bilhões), segundo relatório publicado na segunda-feira (24) pelo Banco Central.

quarta-feira, 26 de outubro de 2022

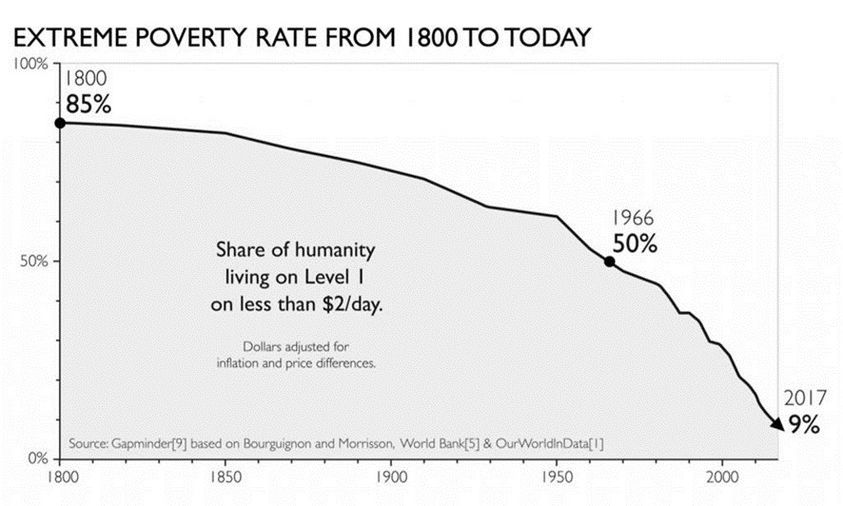

Economia growth

CHARLESKOCHFOUNDATION.ORG

Joel Mokyr: Progress is human made, but not predestined - Charles Koch Foundation

Joel Mokyr is the Robert H. Strotz Professor of Economics at Northwestern University. He also is a professor of history and co-directs the university’s Center for Economic History. Mokyr conducts research on the economic history of Europe, specializing in the period from 1750 to 1914, or what has ...

segunda-feira, 24 de outubro de 2022

Assinar:

Postagens (Atom)